Strong Marketing Performance Increases a Startup’s Valuation

Author

Aaron BransonLearn how to maximize company valuation by measuring marketing contributions in financial terms.

For startups, a robust marketing engine and a recognizable brand are often overlooked as substantial assets, but they can significantly impact a company’s valuation. While many founders focus on short-term revenue growth and product development, a strong marketing presence is critical to directly drive sustainable growth through new customer acquisition, net revenue retention, and pricing power—all of which affect the financial metrics that investors use to assess value.

However, how to clearly quantify the financial value of a company’s marketing presence is not immediately obvious. Here’s how to view marketing as a financial asset and quantify its contribution to a startup’s valuation.

The Connection Between Marketing and Valuation

Marketing and brand perception influence valuation in two key ways:

- Revenue Growth and Efficiency: A strong marketing presence reduces Customer Acquisition Cost (CAC), improves conversion rates, and creates more predictable revenue growth.

- Profitability and Value Creation: A trusted brand establishes pricing power, fosters customer loyalty, and creates differentiation in the market.

Investors assess these factors not just qualitatively but also quantitatively when determining valuation.

Company leaders who invest strategically into their marketing function not only reap the direct returns in sales, but also make the company more attractive to a buyer.

Quantifying the Dollar Value of Marketing Strength

Here’s are two practical frameworks to calculate how marketing contributes to a startup’s valuation:

Method 1: Marketing Lift

Brand Awareness Value

A strong organic presence (i.e. search presence, social reach, content proliferation) and mindshare within the target market drives inbound leads, reducing dependency on paid acquisition channels.

Identify a Key Result that best represents a strong organic presence – mindshare or brand awareness. A commonly accepted proxy would be Organic Website Visitors. This metric, by definition, intentionally excludes paid traffic and expressly focuses on unique visitors (individuals), not visits (browser sessions).

Calculation: Estimate the cost of replicating organic traffic using paid advertising.

Example: If a startup generates 100,000 monthly website visitors organically and acquiring the same traffic via paid search ads costs $250,000/year, that represents $250,000 in annual marketing savings.

Applying a standard SaaS ARR multiple (e.g., 8x), this adds $2M to the company’s valuation.

CAC Savings

Efficient marketing drives down the cost of acquiring new customers, freeing up resources to scale faster. Failing to invest in a strong marketing presence keeps companies on the lead gen “hamster wheel” spending and sweating feverously to fill the funnel with more and more typically low interest leads.

Calculation: Compare the startup’s CAC to industry benchmarks.

Example: If competitors have an average CAC of $3,000 per customer but the startup’s CAC is $2,000 due to superior marketing, the startup saves $1,000/customer.

Applying an 8x multiple, this adds $4M to valuation.

Pricing Power

A strong brand allows startups to charge premium prices, increasing ARR without additional costs.

Calculation: Measure the revenue uplift from premium pricing.

Example: A startup with $5M ARR charges 10% more than competitors due to brand preference and differentiation, adding $500,000 to annual revenue.

At an 8x multiple, this adds $4M to valuation.

Retention and Lifetime Value (LTV)

Brand trust and effective marketing improve customer retention and increase upsell/cross-sell opportunities, boosting LTV.

Calculation: Compare the startup’s LTV to competitors.

Example: If the industry average LTV is $10,000/customer but the startup achieves $12,000 due to higher retention, the additional $2,000/customer across 500 customers equals $1M in extra lifetime revenue.

Applying an 8x multiple, this adds $8M to valuation.

Total Contribution of Marketing "Lift"

Let’s summarize these calculations for a hypothetical SaaS startup with $5M ARR:

- Organic Marketing Value: $2M

- CAC Savings: $4M

- Pricing Power: $4M

- Retention and LTV: $4M

Total Additional Value from Marketing = $18M

Adding this to the base valuation (e.g., 8x ARR = $40M), the startup’s adjusted valuation rises to $58M (11.6x ARR) — a significant premium driven by its marketing strength.

Warnings Against the Marketing Lift Method

The challenge with the Marketing Lift method is the risk of “double-counting” as some of the lift factors overlap with the revenue already calculated into the based valuation. For instance, one could argue that pricing power is baked in as it should be reflected in the ARR already. One would need to prove that the “lift” factors are truly unaccounted for in the base revenue valuation.

Nonetheless, this method proves to be a useful exercise in determining whether the startup’s growth is sustainable and likely to continue, or is artificially propped up by unscalable factors – one stellar sales rep, overpaying for lead generation, or too heavily reliant on one customer cohort.

Method 2: Marketing Asset Value

At Revup, we subscribe to this model as it is completely independent of the already attained growth reflected in the ARR ($5M in this example). Marketing already influenced the attained growth in past sales, and pipeline of future sales, but what is lacking is a measurement of the long-term sustainable growth already influenced by marketing that will likely become pipeline and later, sales.

Marketing Asset Value can be broken down into three factors:

- Short-Term Growth: Sales attributable to marketing

- Mid-Term Growth: Pipeline attributable to marketing

- Long-Term Growth: Strategic Positions attributable to marketing

These factors become increasingly more challenging to measure as they move further away from the point of a closed-won sale.

Measuring Sales? Easy enough with the reliable lead source attribution data and an agreed upon model.

Measuring Pipeline? Very doable – just be precise with defining what is and what isn’t to be considered “pipeline”.

Measuring Strategic Position? OK, this is where many startups and investors give up. What even is strategic position – tangibly speaking? The answer depends on the business. It could be A) becoming a “best place to work” to improve talent retention, B) inclusion in an industry report that defines the category leaders, or C) generating more daily active users for a product-led growth SaaS tool. All of these are prime examples of strategic outcomes marketing can be the primary driver of, though they are commonly overlooked in measuring marketing value or marketing ROI.

Identifying Strategic Marketing Outcomes

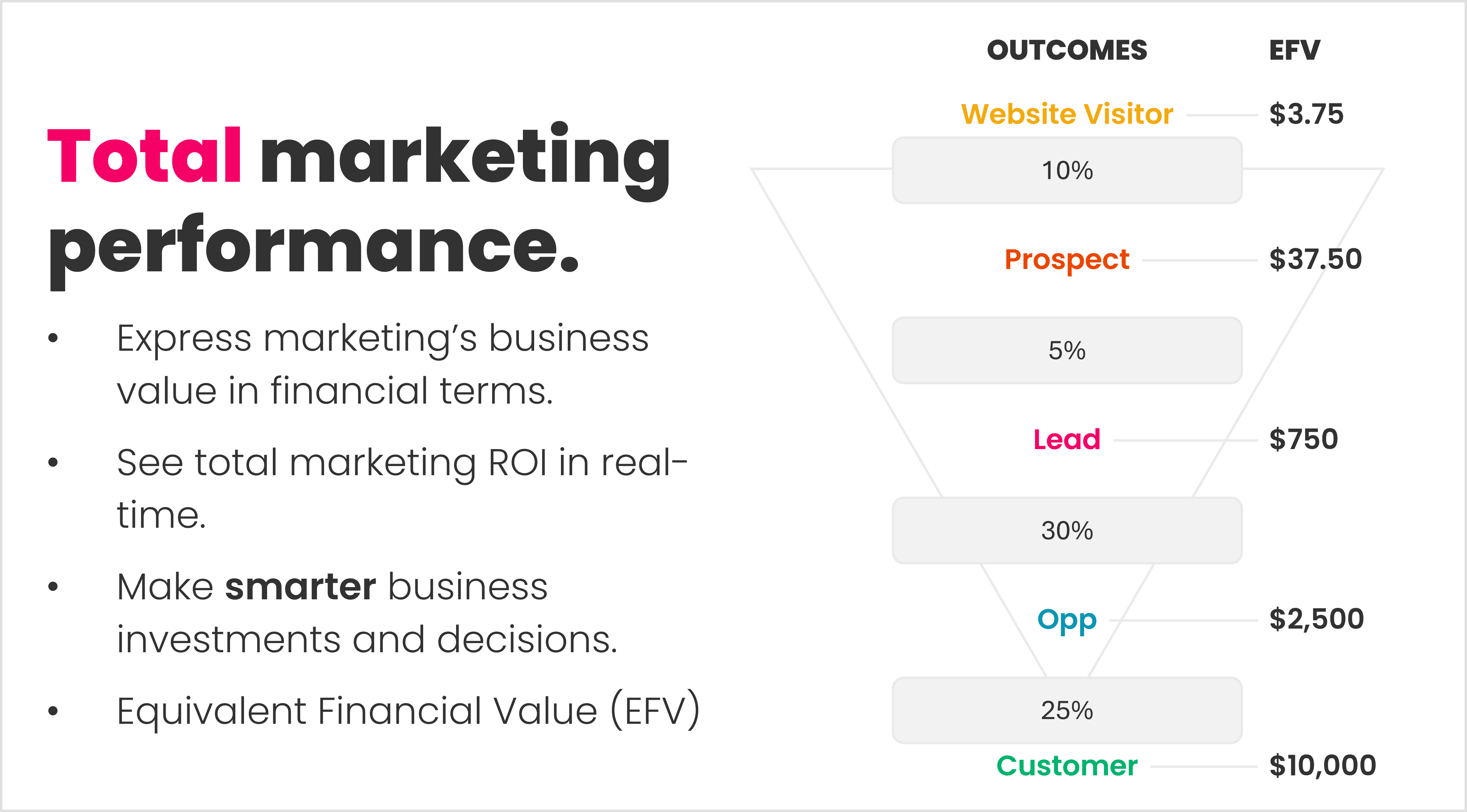

All three Marketing Asset categories are made up of Marketing Outcomes (i.e. a deal, an opportunity, a lead, an organic website visitor, an award, a report, or a daily active user) and each has an Equivalent Financial Value (EFV) that represents what that outcome is worth to the business. Another way to say it “What’s the most the company would be willing to pay for that outcome?” But how do you calculate such a thing? That’s where EFV comes in.

Calculating Equivalent Financial Value (EFV)

It starts with defining marketing’s strategic outcomes. Otherwise known as the Key Results in Objectives & Key Results (OKRs). There are generally two types of OKRs that marketing is tasked with achieving to add value to the business – those defined by the sales funnel stages and everything else. This is not only an exercise in measuring marketing’s business value, but also absolutely necessary to align marketing’s strategy and execution to what’s most important to the business.

Individual Outcome EFV = Key Result Quantity * Key Result Unit Value

- Example: 200 Leads * $500 = $100,000 EFV

- Example: 50 Opportunities * $2,500 = $125,000

- Example: 10 Deals * $12,000 = $120,000

Marketing Asset Value = Sum of each Outcome EFV above

- Example: $345,000 EFV

By categorizing all of Marketing’s outcomes as either Sales, Pipeline, or Strategic, you can truly measure the financial impact of marketing.

So, let’s compare 🍎 to 🍎 with our first method, Marketing Lift.

Total Contribution of Marketing Asset Value

It starts with defining marketing’s strategic outcomes. Otherwise known as the Key Results in Objectives & Key Results (OKRs). There are generally two types of OKRs that marketing is tasked with achieving to add value to the business – those defined by the sales funnel stages and everything else. This is not only an exercise in measuring marketing’s business value, but also absolutely necessary to align marketing’s strategy and execution to what’s most important to the business.

Sales (Short-Term Growth)

- $1,000,000 EFV (100 New Customers at $10,000 Average Deal Size)

Pipeline (Mid-Term Growth)

- $1,240,000 EFV (620 Opportunities at $2,000 Unit EFV)

Strategic (Long-Term Growth)

- $900,000 EFV (9,000 Leads at $100 Unit EFV)

- $975,000 (325,000 Organic Website Visitors at $3 EFV)

- $385,000 (Inclusion in industry’s “mystical quartiles” report expected to provide 5% sales lift)

- $500,000 (Award of “best places to work” expected to reduce turnover cost by 10%)

Summing the Equivalent Financial Value of marketing assets, we get:

Total Additional Value from Marketing = $5M

This figure is valuable in justifying the marketing budget to achieve these results. Assuming a 3X marketing value return on investment, an annual marketing budget of $1.67M for this company is a smart investment.

Likewise, this information is valuable in justifying a premium on the company’s valuation that only factors in current ARR. By measuring the financial value of Marketing Assets as proxy for short-term growth (Sales), mid-term growth (Pipeline) and long-term growth (Strategic), the $4.89M total equivalent financial value can be added to the base valuation (e.g., 8x ARR = $40M), the startup’s adjusted valuation rises to $45M (9x ARR) — a nice premium driven by its marketing strength.

But wait! The Marketing Lift method provided a much higher bump in valuation attributed to marketing. That’s true. But considering marketing’s contribution to the revenue used to calculate the base valuation, we feel the Marketing Asset Value method provides a more clean, conservative and accurate reflection of the value-add outside of revenue – avoiding the “double-count” challenge - and therefore stands up to scrutiny.

Long-Term Valuation and ROI-based Marketing Budgets

Marketing Asset Value should be measured as a premium on the company’s valuation to reflect the likelihood of sustaining that growth through equity built up by marketing strength.

Not only that, but this method also provides a great answer to ROI-based budgeting by defining these OKR targets and the value they represent to the business.

Why Investors Value Marketing

From an investor’s perspective, a strong marketing presence provides confidence in:

- Scalability: Marketing systems that are already efficient can scale with less capital.

- Sustainability: A robust pipeline of leads and strong brand loyalty create reliable growth.

- Profitability: A recognized brand can carry pricing power and a higher level of trust.

Startups with proven marketing engines and strong brands not only de-risk the investment, they also unlock premium valuations.

In short, marketing is not just a cost center or solely a revenue center – it produces financial assets. By quantifying the financial value of marketing’s strategic objectives and key results, startups can demonstrate how their marketing efforts directly contribute to higher valuations. For founders, this means making marketing a strategic priority. For investors, it means recognizing marketing as a key driver of ROI.